China has for years now been a business hotspot for world-leading architectural firms, and Shanghai is of course one of the cities to benefit from the influx of building design creativity. Shanghai Tower, which we profiled in a recent issue of this newsletter, is far from the only impressive building being erected as a result of this trend. Following are renderings of five more spectacular projects that will further diversify the city’s skyline in the coming months and years, each representing an exciting new option for the city’s office space tenants.

| The Bund Finance Centre (BFC) Architectural design: Foster & Partners Status: Under construction Location: The Bund at Fuxing Road East Scheduled completion: 2015 Images courtesy of Foster + Partners and Heatherwick Studio | |

| Sky SOHO Architectural design: Zaha Hadid Status: Under construction Location: Near Hongqiao transportation hub Scheduled completion: later this year Images courtesy of Zaha Hadid | |

| Hongqiao Business District Architectural design: MVRDV Status: Under construction Location: Near Hongqiao Airport Station Scheduled completion: 2015 Images courtesy of MVRDV | |

| Shanghai Baoye Center Architectural Design: LYCS Architectur Status: Under construction Location: Phase II of new Hongqiao CBD Scheduled Completion: 2014 Images courtesy of LYCS Architectur | |

| SOHO Hailun Plaza Architectural Design: UNStudio Status: Under construction Location: Siping Road @ Hailun Road Scheduled Completion: 2016 |

Images courtesy of SOHO Hailun Plaza, 2014, UNStudio © (Ben van Berkel, Caroline Bos, Astrid Piber with Hannes Pfau, Markus van Aalderen and Luis Etchegorry, Ger Gijzen and Cynthia Markhoff, Veronica Baraldi, Joerg Lonkwitz, Shuojiong Zhang, Severin Tuerk, Paxton Sheldahl, Tomas Mokry, Nathan Melenbrink, Caroline Smith, Dan Luo, Yue Zhou, Alan Chin Che Hung, Nan Jiang)

The Key Housing Market Indicator

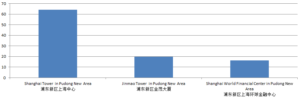

| The big question on the minds of those with an interest in China’s economy continues to be the nation’s housing market and whether it is headed for a crash. While pundits are still arguing about whether the market will suffer a complete collapse or not, almost all economist now seem to agree that housing prices will fall significantly before a rebound inevitably occurs. How do they know?Some folks might argue that so far the overall drop in home prices has been very small and therefore the future trend is uncertain, but they are looking at the wrong number. The small size of price changes in recent months obscures the magnitude of a greater trend that has been taking shape. That greater trend has to do with the monthly changes in number of housing transactions, which is a better indicator of the overall health of the market.The chart above shows that demand for new homes in major cities has fallen dramatically over the last year and a half, with the number of new home transactions during the first six months of 2014 showing year-onyear decreases of 30%, 40%, 26%, 21% and 73% for Shanghai, Beijing, Guangzhou, Chongqing and Hangzhou respectively. This huge fall in demand is surely not due to lack of people wanting to buy homes in China; it’s due to the fact that the country’s home prices are absurdly high relative to the average person’s income. So while we at Sofia Group don’t foresee a full-blown market crash, we do expect that there will be low double-digit price corrections in many cities, because where demand goes, prices must eventually follow. |

Market Data – Rents and Occupancies

The general patterns of occupancies and rents across Shanghai’s districts remains largely unchanged since our last newsletter.

The opening of spaces within the new Oriental Finance Center at the intersection of Lu Jia Zui Ring Road and Yincheng Road will add much needed supply to the Lujiazui Financial District in coming months, but this will hardly affect the area’s rocketing office rents. Space in OFC is commanding rents of around RMB 11 – RMB 12 / sqm / day.