The opportunities and cost advantages may be greater than ever, but they now come with higher risk

After three pandemic years, trade wars and growing geo-political tensions over all sorts of issues, China investments no longer seem to be the no-brainers they once were. The following reasons for and against investing in China are just a small subset of many considerations, but they are among the ones that matter most to corporate decision makers.

For: Largest Single Market

China is still the world’s largest or second largest market for many products and services, and a presence in China helps a company serve this market more efficiently by speeding up and cheapening production and delivery of goods, and making local markets and relationships more accessible.

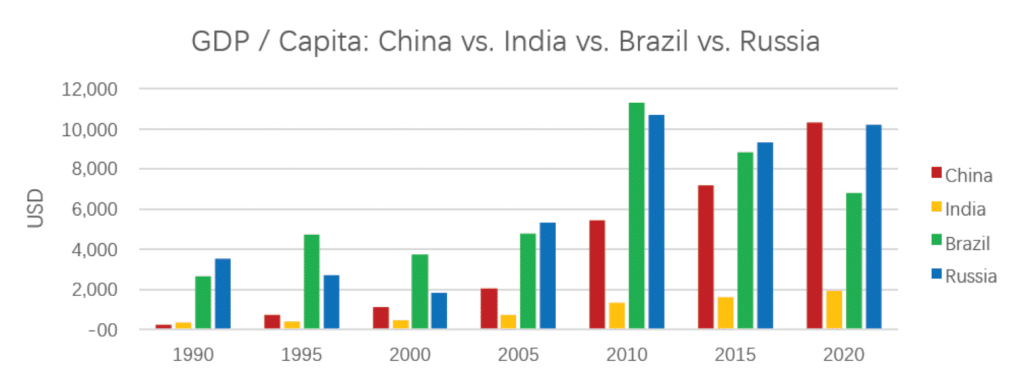

Not only is the China market big, it is still growing in a big way. Pandemic trends aside, the spending power of Chinese consumers and businesses is rising, with GDP per capita growing impressively over the past years, especially as compared to the other BRIC countries (Brazil, Russia and India):

The enormous potential of this growth is well illustrated by Starbucks, which sells coffee at slightly more expensive prices in China than in the US. With over 6,000 stores in China already, the company aims to expand at a rate of one new store every nine hours over the next three years to bring its China network to 9,000 stores by 2025.

Other companies riding China’s growth include Apple, which has reported that China accounts for 18.82% of its revenue, and Volkswagen, which makes about 34% of its profit in China.

For: Supply Chain

Market size is not the only reason why China remains a major FDI destination. Its abundance of skilled talent and low-cost labor is the envy of many nations. The country also has a wealth of natural resources, robust industrial supply chains and modern infrastructure.

Over the past five years many international companies have in a so-called “China-plus-one” strategy set up new locations across Asia. The idea is to set up one or two production sites in countries like Malaysia, Vietnam, Indonesia or India to complement an existing five to ten production sites in China. At first glance some of these Asian countries provide an even better cost structure. But many of our clients have reported that a lack of mature infrastructure, skilled talent and suppliers of needed raw materials eventually led to frustrations and difficulties in competing with sites in China.

Each year in China some 10 million university graduates enter the workforce looking job opportunities. In addition, the Chinese government is keen to attract foreign direct investment (FDI), and international companies bringing FDI into China are hence presented with bigger subsidy packages than ever before, including access to free production facilities, subsidized equipment purchases, tax holidays and other benefits.

Against: Financial Risks

China’s financial system has been stable over most of the past 40 years. When the global financial crisis of 2009 hit, China was one of the countries least affected, and indeed helped pull the world out of that particular hole.

But China’s financial situation now looks less reassuring. One result of three years of zero-covid with its regular mass testing of 1.4 billion people, travel restrictions, lockdowns and other inconveniences is that most of China’s local governments have taken on large amounts of debt. Debt accumulation has also been driven by large amounts of infrastructure development in rural areas targeted for poverty alleviation.

This accumulation of debt comes right as various factors are making it harder for local governments to raise revenues. Central government’s recent success at cooling down the real estate market is undercutting local government’s revenues from land sales. A tightening of environmental regulations not only costs money to enforce but is also making it more challenging to attract corporate investments. Third, an international climate where China is regarded as perhaps not so reliable as it once was ultimately impacts local businesses and the amount of taxes they contribute.

Were overleveraged local governments become unable to service their debt it would pose a major problem for China’s economy. Foreign businesses will want to keep in mind here that China has strong capital controls in place, and it can take time to obtain all the relevant permissions for moving money out of the country.

Against: Geopolitical Risks

Given that about 50 years ago China found itself in its weakest economic and military position, it is understandable that Chinese leaders today are less willing than their counterparts in the West to accept the world order and borders set right after World War II. While China is one of the countries that over the past few hundred years rarely initiated a war, it is increasingly positioning itself as the second world power next to the US and demanding a leading role in Asia especially but also globally. The biggest risk obviously revolves around Taiwan, where China expects a reunion sooner or later.

The Future Balance

It seems that the past five years have created a global environment of higher risks and higher rewards. Fluctuating interest rates, inflation, shipping industry bottlenecks, sharply rising energy costs across Europe and other challenges allow agile companies to benefit from significantly higher cost advantages than before when investing and operating with a global view. Making use of these opportunities requires the boldness to act independently and avoid the herd mentality of only moving into a market or adopting a business model when everyone else has already done so.

If China plans to one day reach a fully socialist or even communist society then it could become close to impossible for international companies to do business here. But if there is to be such a future it still seems far away. For many companies needing to set up manufacturing sites now, China remains the most attractive destination for their FDI moves. Whether and for how long that will continue to be the case will depend on the choices made by China’s leaders in the years ahead, and how the world responds in turn.