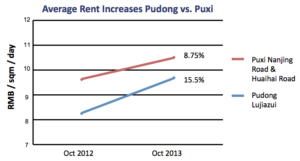

In Shanghai an apartment that costs USD 1 million typically rents for around USD 1,900 per month, while an office unit that costs the same typically rents for around USD 3,800 per month. Where does this difference come from? Have we discovered a rule of thumb, that when it comes to property in China one should rent residential but purchase commercial?

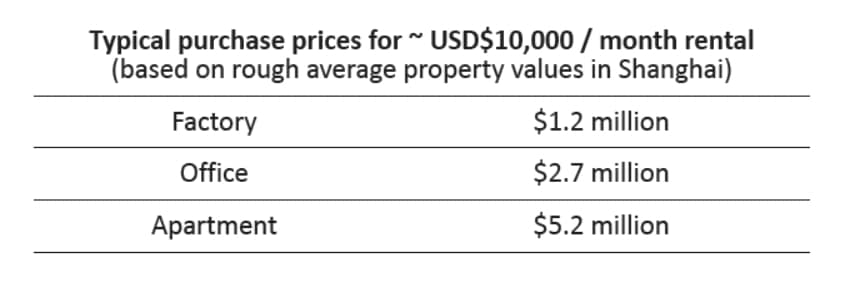

Even greater contrasts arise if we compare factory buildings to commercial or residential properties. Let’s say three tenants are paying a monthly rent of USD 10,000 per month for, respectively, a factory, an office and an apartment. How much it would typically cost each to buy their property can be seen in the table below.

It’s mostly about money

There are many reasons why residential properties are much more expensive to buy than offices or factories. The main one is probably that in China – as well as in some other Asian countries – people tend to invest into apartments with a goal of asset appreciation, largely ignoring the property’s annual yield, or how much income the property will generate compared to its purchase price. For China’s big city apartments, that income is often so low that it cannot even cover mortgage payments.

With commercial properties the opposite holds true. Whether an office building, shopping mall, factory or warehouses, a commercial property is typically developed and bought with the aim of having an attractively high yield – high enough in order to be cash flow positive even after making one’s mortgage payments.

What this boils down to is that essentially nobody in China buys an office if the actual or potential annual rental income isn’t at least about 4.5% of the purchase cost, but people are willing to buy an apartment even if the actual or potential annual rental income is only 2.3%.

Non-financial considerations

A cultural aspect also plays an important role. Many families believe it’s important to own one’s place of residence and, especially among young people, the purchase of an apartment stands high on the priority list. Near and far relatives sometimes pool money together in order to enable the initial down payment.

There are also solid legal reasons why people tend to accept higher ‘multiples’ when it comes to residential real estate – about 42 years of rental payments to equal the purchase price, as compared to only about 10 to 12 years when it comes to factories. The duration of land-use-rights (LUR) is one. For residential land, the land-use right period is typically 70 years, while for industrial properties it is usually 50 years and commercial 40 years. After owning a property for 25 years, you still have 45 years left to collect rent if it’s an apartment, but only 15 years if it’s an office.

And then there is the issue of LUR renewals. No one knows for sure what will happen at the end of the LUR period of any property type, since the rules have yet to be set. But for residential the law does say that there must be a mechanism to renew one’s LUR, whereas for commercial and industrial properties there is no such guarantee. In reality there will probably be a renewal process for all LUR types, and likely none will be free of charge. Authorities have been discussing real estate ownership taxes for quite some years now and they could be applied to residential as well as commercial and industrial properties. It seems somewhat likely that such taxes will be lower for residential properties and higher for commercial and industrial properties.

What firms are actually doing

Considering the above facts regarding rental vs. purchase costs, it would seem that it makes most sense to purchase in the case of industrial property. Yet many international companies these days are still shifting their focus towards renting factories and warehouses instead of owning them, some even disposing of their current industrial real estate through sale-and-leaseback transactions. This may have to do with wanting to be asset light and flexible, and the belief that capital invested into a business will create higher returns than capital stuck in properties.

On the whole it seems that family-owned businesses are the ones most inclined to own their real estate. One reason they may prefer to buy is that ownership indicates stability of one’s business. And while on one’s books the value of company properties can be written off, in reality property values tend to grow, delivering a silent capital appreciation which is real for the owners, even if it’s not included in any financial reports.