In the second half of 2018, there were several deals that grabbed the headlines. It is always interesting to reflect on what this may mean for the broader market, so we will highlight a few that caught our eye.

Firstly, in mid-September Allianz announced that it had partnered with a private equity investment fund managed by Singapore’s Alpha Investment Partners, and a second unnamed investor to acquire an office property in Shanghai’s Bay Valley Business Park. The investment group committed to a transaction that valued the 13-storey Bay Valley C6 building at approximately US$90 million.

There is clearly confidence in the growing demand for office space in areas to the north of Shanghai’s downtown. With Fudan University locating their new campus in this area and several other major investments in Bay Valley, it seems that Yangpu will continue to see development and growth well into the coming year.

Another major September acquisition was that of six buildings at No. 328 Wankang Rd., Minhang District by CLH. The project supplies 43,096 sqm of gross floor area and is made up of four independent office buildings and two innovation and technology R&D buildings. CLH paid RMB384 million for 80% equity in Shanghai Junbo Textile, whose only major assets are the aforementioned building situated in a boutique innovation and technology ecological park.

Minhang district has always been a popular residential location, especially among expats, with its range of top-tier international schools and wide choice of luxury villas near developed shopping areas. However, it is also amassing increasing commercial attention even outside of the establish Minhang Development Zone.

In November, CapitaLand announced that it had acquired the Star Harbour International Center project in a 50:50 joint venture with Raffles City China Investment Partners III (RCCIP III). The project, which will open in phases starting later next year, is the tallest twin tower development in Shanghai at 263 metres tall. With access to Metro Line 12 and the future Line 19, and a total GFA, including car park, of 421,170 sqm, this certainly falls under the category of a landmark development. The acquisition also means CapitaLand’s Shanghai property portfolio now consists of over 1.8 million sqm in GFA.

Hongkou, where the project is located, is clearly an evolving area, with faster than average growths in rent and several other major developments underway. The area is considered a key extension of Shanghai’s core CBD and with limited new supply in the Lujiazui zone, it is expected that rents will continue to rise in the near future.

Finally, just as the year drew to a close, there were two final blockbuster deals: another development located in the Minhang district and one in Hongqiao. The US alternative investment giant, Blackstone Group, acquired five buildings in the Mapletree Business City Shanghai office complex alongside the adjacent Vivocity Shanghai mall. The deal, amounting to US$1.25 billion, saw Maple Tree Investments part with over 200,000 sqm of office and retail space from a development that was the Singaporean groups largest single investment in China to date. Around the same time, Gaw Capital Partners made a US$390 million investment in four Grade A office buildings in Hongqiao. The complex amounts to 60,807 sqm of office space in an area that benefits from its close proximity to the Hongqiao transportation hub.

Although deals of this size may not be perfect indicators of overall market conditions, they are certainly a positive sign for Shanghai. While there is continued pressure on investment funds to place money into yield generating assets, the current economic environment of low interest rates and uncertainty in the markets leaves commercial and industrial real estate as one of the few reliable places where this is still possible. The positive growth of investment in real estate has also led to vastly increased office supply, which means that for the first time we may be looking at a drop in rental rates. Such a result would certainly promise an exciting 2019 for real estate in Shanghai.

Market Notes

By end of 2018, the demand for office space among finance and consulting firms remained stable, while new energy and R&D for artificial intelligence enterprises were more active in the leasing market.

In new energy, Tianyuan Manganese Industry Group leased 2,550 sqm of space at Century Link. R&D enterprise, Autoliv and Veoneer, took 4,000 sqm and 5,000 sqm of space at SCE Plaza in Hongqiao.

As the global economy continues to slow down, companies tend to be cautious about relocating, expanding and setting up new offices because office leasing accounts for a large proportion of their daily operating costs.

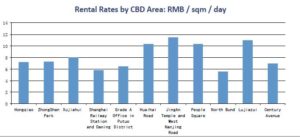

In Lujiazui area, the average rental remains at RMB 13.0/sqm/day. Financial insurance, law firms, consulting and other industries with strong finances are keen to set up offices in the core business district, which has become an important factor in avoiding a decline in rent in Lujiazui.

Take the following firms as examples:

UBS leased 1,200 sqm in Taiping Finance Tower.

Zhonglun Law Firm renewed 6,000 sqm of office space in IFC.

China Continent Property & Casualty Insurance Company leased 12,000 sqm in Shanghai Tower.

The average rental at North Bund in Hongkou is RMB 7.3/sqm/day. As a market dominated by shipping and finance, the north bund attracts many important enterprises to settle there. British law firm Ince & Co has moved from Park Place to Magnolia Plaza, renting 1,200 sqm of office space.

In Q4 of last year, more than 700,000 sqm of new supply came onto the market, and the new supply in Hongqiao business district and foreshore will account for more than 30% of the total. The Foxconn building in the core area of Lujiazui was also completed and put into use during this period.