The August 2021 start of the Evergrande financial meltdown was a momentous turning point in China’s real estate market.

It marked the beginning of the end to the steep decades-long rise in property prices that had up till then accompanied China’s decadeslong economic boom. It also marked the beginning of the destruction

of a vast amount of wealth, and a significant shrinking of China’s real estate and construction sectors, which at the time accounted for some one-third of the country’s GDP.

Last month’s delisting of Evergrande from the Hong Kong stock exchange was a sort of quiet ending to the firm’s bankruptcy saga, although creditors are still chasing their money. The event likely prompted many to wonder: Where does China’s real estate market stand now, four years after the unwinding began? Read on to find out.

Residential: purchase prices down but still high, rental rates down

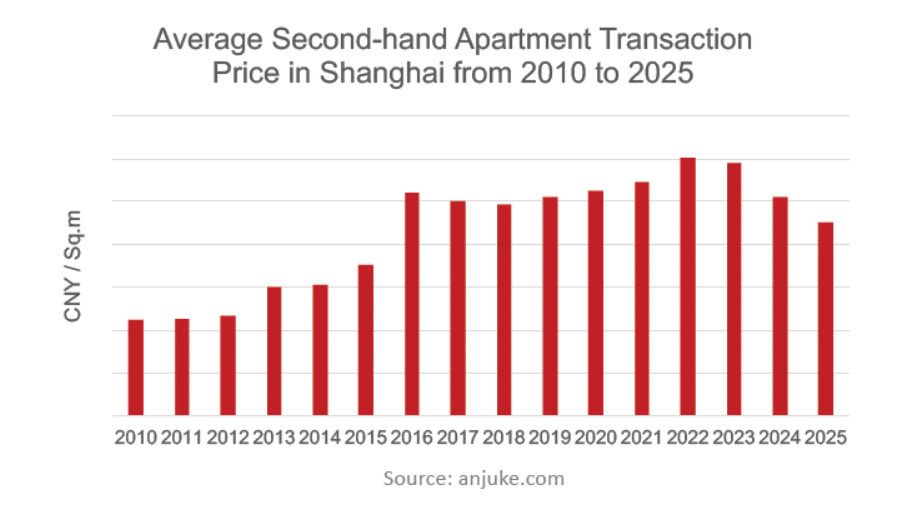

The average price of apartments in China as a whole is now around 30% less than in 2021. The decrease is generally less in first- and second-tier cities, as evidenced in the chart below for Shanghai, where

prices actually went up or remained stable until 2023 and only now experienced a price correction.

While 30% may seem like a gigantic downswing, remember that it comes after a period of 40

years of continuous growth. And from an international perspective, apartment prices in China’s

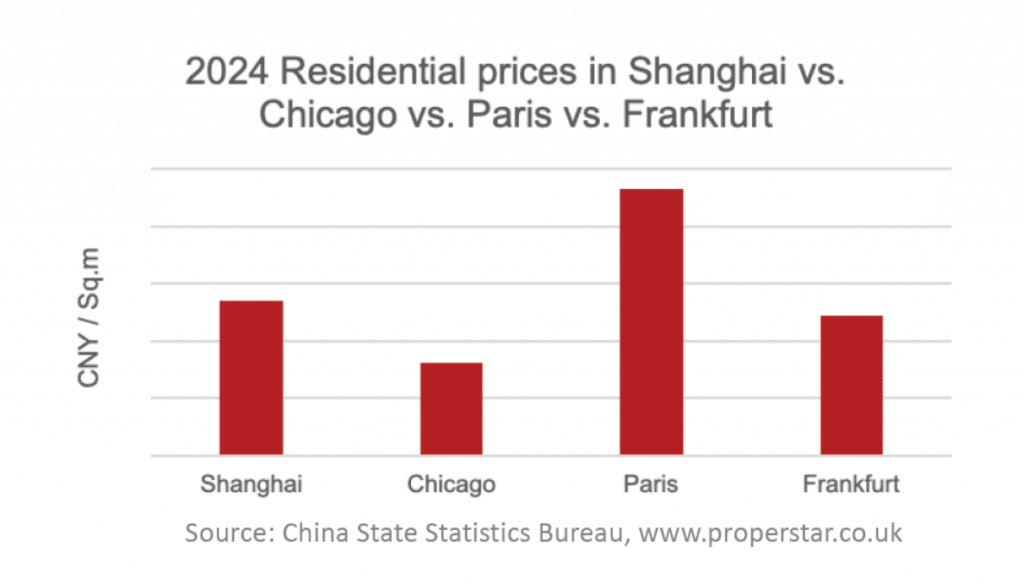

first-tier cities are still somewhat pricey:

Now is probably the best time in the past 15 years to buy an apartment in China for the purpose of living in it. Buying as an investment to rent out is another story, however, as yearly income from residential investments is still only a meager 2.6% on average, in part because the rental market in China’s major cities is softer than before, reflecting an overall weaker economy. One group definitely benefitting under current residential market conditions is tenant-renters, who are now enjoying far better deals when looking to move or renegotiate leases compared to four years ago.

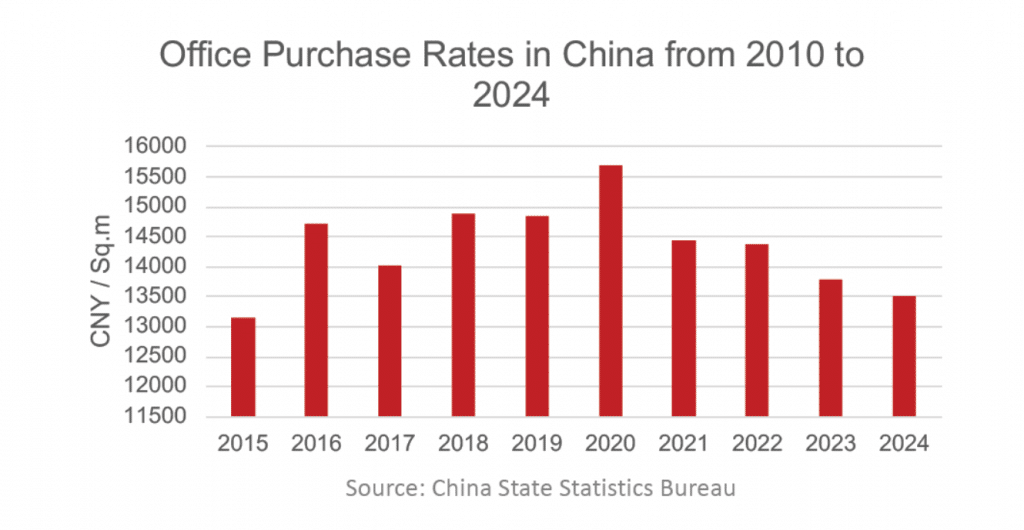

Office: purchase prices way down, rents somewhat down

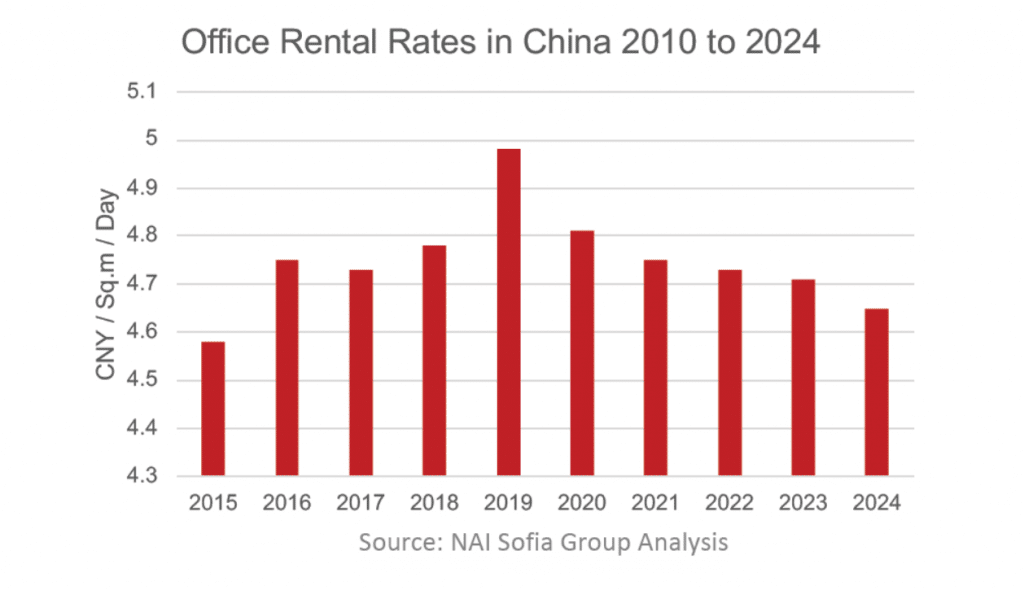

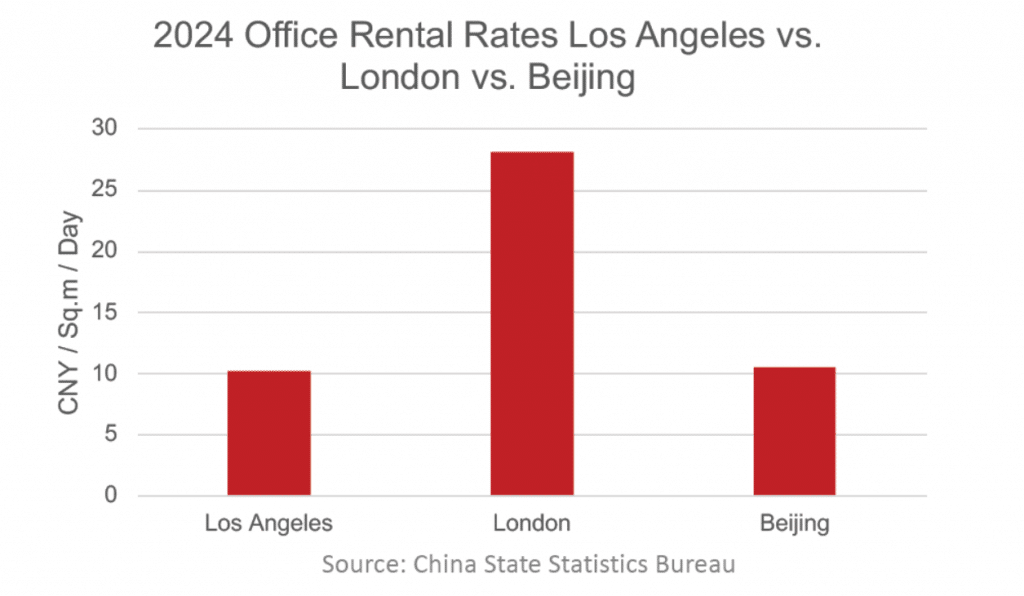

Affected by the housing market turmoil and its economic fallout, pandemic-drive trends and other factors, prices and rents for office space in China have also declined in recent years.

While rents in top tier cities are down ‘only’ about 15% from their peak in 2019, purchase prices have dropped by around 50%, indicating that investors now demand higher returns on office building investments compared to four years ago. Aspects like a gloomier outlook on future price developments in China may be playing a role, as well as the global decline in office take-up and office property valuations, which is largely attributed to increased work from home.

With purchase prices far below their peak, offices in China have become an attractive investment for companies intending to self-use their space as well as for investors looking for yields, which now are at around 8%. Of course buyers still need to perform due diligence and evaluate such factors as remaining land-use-right periods, building quality and occupancy level before deciding on an investment. For companies looking to renew an existing office lease, there are opportunities for significant savings, and firms considering a move will find that landlords nowadays tend to offer attractive packages with low rents, long renovation and rent-free periods and additional perks.

Industrial: largely stable, warehouse buildings down a bit more than manufacturing premises

Real estate developers in many China cities focused on developing warehouse buildings in the period 2015 to 2022, the result being current oversupply of logistic parks in some areas. Where this has happened, rents have dropped by as much as 25% and purchase prices by as much as 45%.

Otherwise, in many cities warehouse rents are down by about 10% from their peak, while purchase prices are down around 25%, indicating reduced appetite from global capital and higher yield expectations from investors, who for this asset are often insurance companies.

Property prices in manufacturing business parks seem to be slightly under pressure, with rents down around 10 to 15% overall and landlords offering tenants more concessions in recent years. The actual rental situation for manufacturing properties can vary significantly by location, however, as evidenced by the following chart that shows rents hardly dropping at all in the busy Yangtze Delta cities of Shanghai, Kunshan and Taicang.

Real estate costs are usually not the primary concern for businesses seeking to buy or rent industrial real estate; these firms are in general more concerned with issues such as proximity to clients and suppliers, access to talent, labor cost, and sufficient energy supply. Yet there are great deals to be had for buyers and renters of industrial real estate now, and businesses looking to launch or relocate to a new production site should be sure to seek them out.