For ensuring your overseas property dream doesn’t turn into an investment fiasco

If you’re a regular investor with global outlook, you’ve almost certainly thought about it: Buy a property in a holiday paradise overseas where prices are rising fast, then rent it out to cover monthly payments while using it yourself for holidays and retirement.

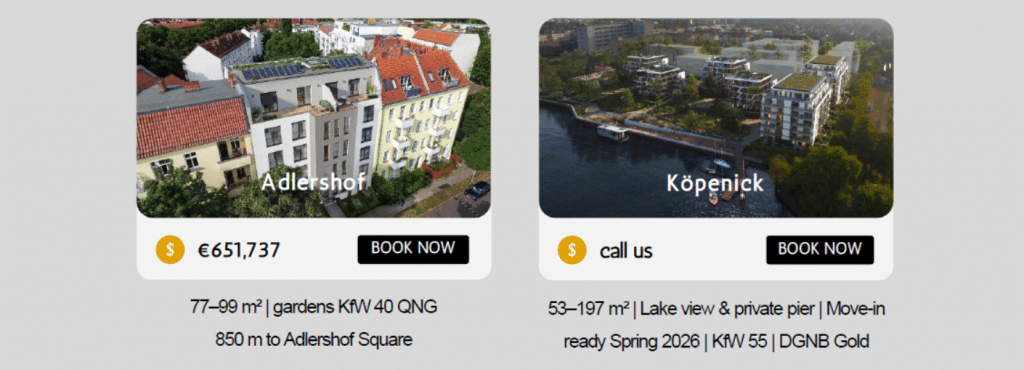

It could be an apartment in a modern and vibrant European city. A luxury bungalow in an Bali. A chic residence in a Middle Eastern beach resort where land values are rocketing….Nice earnings, lovely holidays. What could possibly go wrong?

Overseas market advantages

Much, of course. But before we get to potential dangers, we’ll say for the record that properties are generally good investments, so long as you do your due diligence. Real estate values tend to go up over the long-term in countries with growing economies, and buying and then renting out property is generally a good way to secure a fixed income stream. Financing is also usually easier to obtain for property investments compared to, say, stocks of an equivalent value.

Acquiring properties in a foreign market can also allow you to take advantage of a favorable market cycle phase when it’s a bad time to invest in your own country. And the foreign market might also offer advantages such as lower property taxes, or residency-for investment schemes.

Landmines to avoid

But while real estate is usually a forgiving industry over the long term, with a majority of investment turning out profitable, careful consideration of risks associated with your investment is crucial and necessary before investing.

Below are 10 major risk points to consider:

1) Title risk:

Is the seller in a position to sell this property to me? Will I own it freely once the transaction has been completed?

2) Overpaying

Ask yourself whether the property’s price is good in view of current local market conditions. Equally important, ask: What’s the expected yearly rental income as a percentage of the purchase price? A recent drop in market prices is no better indication that it’s a good time to buy than is a 5-year trend of rising prices. Analyzing how much rental income to expect in a year tends to be a better data point. Is the yearly return 5% or more? (It should be.) Will the rental income at least cover monthly interest and principal payments?

3) New supply and vacancy risk:

In the foreseeable future will there be a lot of newly constructed buildings that are similar to my investment entering the market? Is there a risk that my target tenants will in the future prefer another area of the city, potentially leading to prolonged times of vacancy?

4) Financing risk:

For how many years can I fix my interest rate and how much will I owe when the mortgage needs to be renewed? How high is the risk of my monthly payments increasing when I renew?

5) Free-hold:

Do I own the land-use-rights without limitation, and will the property be mine with no time limit? If not, will the time limits on my ownership satisfy my needs?

6) Usage:

Are there limits to what my property can be used for? Can I rent out my apartment on a short term basis through platforms like AirB&B? If buying an office space, will you be able to use it for running your lab tests, or convert it into that nail studio business you hope to launch?

7) Rent control:

Is my property in an open market environment, or do local laws limit the amount of rent that I am allowed to charge?

8) Taxes and fees:

How much of my rental income will I need to spend on real estate taxes and similar charges?

9) Project completion:

If the project in question is still under construction, what happens if its completion is delayed or never happens?

10) Repatriation of capital:

When I finally sell my property, can I easily transfer my capital as well as profit out of the country?

Real estate ownership has made and kept a lot of people wealthy, but people also regularly fail in this game by making poor decisions. To maximize your chance of success, do your best to avoid scams, make decisions based on sound evidence and reasoning, and steer clear of the risks we’ve outlined here.