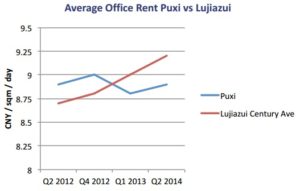

Owners of commercial properties in Shanghai and many other China cities are in a pickle, with three trends converging to negatively impact their businesses.

First, overbuilding has resulted in an excess of office and retail space relative to demand. Local governments have strongly promoted commercial real estate development for years because it attracts new

companies, their main source of ta¬x revenues. They did this through policies that made new projects easily profitable. But too much of a good thing is always bad, and a mild excess of commercial space in Shanghai has been pulling rents down.

The second trend challenging Shanghai’s landlords largely follows from the first. Seeing less need for new commercial development, and questioning the financial viability of commercial real estate

businesses, local governments have made it harder for these companies to obtain funding through bank loans, IPOs, bond sales or other means. So landlords now have less money available for new projects, building upgrades and propping up cash flows.

And now we have the coronavirus pandemic. Its dampening effects on the world economy are clearly impacting China’s commercial real estate markets. In Shanghai, we have seen numerous foreign companies cancel or postpone plans for new projects and leases, and downsize operations, and the same is happening with many domestic enterprises. The pandemic is certain to continue delaying foreign investments and slow office space take up for at least the next 6 months, and probably much longer.

At this point many landlords have given up on reaching earning projections and profitab¬ility targets, wholly focusing on damage control instead.

One Man’s Pain Another Man’s Gain

These difficulties facing landlords are of course blessings to tenants, who can now can get deals which were impossible to imagine just a year or two ago. Landlords are keen to not have too much space sitting vacant over a long period, and are therefore offering heavy rental concessions.

In recent months we have helped a number of tenants acquire new offices in cost reduction programs that actually resulted in better facilities for our clients. Their company headquarters was pleased with the rental savings, and the local entity delighted with the newer and better facilities.

One obstacle of note in these undertakings can be cash flow considerations: Since in China renovations are typically undertaken by the tenant, and since these investments can be substantial (around 6 to 9 months in rent), a challenge is to convince headquarters of the overall saving which may only become visible in year two or three. But creative solutions can be found in order to arrive at an immediate cost saving and

make the effort cash flow positive from year one – all while still realizing an upgrade in real estate premises.

For example, we know a few landlords who are now able and willing to provide interior decoration such as glass partition walls, flooring, air-condition adjustments and so on. More commonly it is still the tenant who has to take care of renovation work, but with long enough rent-free periods this also can be absorbed and made cash flow positive from year 1.

The key is that landlords often prefer to report vacant space to their financial backers rather than rent it out below market or projected rates. This is because the financial backer will easily view (with alarm) a significant drop in rental rate, fearing that all the space in the building will eventually rent at the lower rate and reduce their return on investment. So to avoid cutting rents, landlords may offer an initial decoration period that

is billed partly into the lease and partly granted as an ‘early handover of premises’ or ‘early access to premises’. The terms will allow the tenant to carry out renovation work and enjoy a rent-free period before the official lease begins, the latter long enough to make the office upgrade profitable from year 1.

At this moment it is good to see many companies still developing and growing their activities in China, despite the pandemic and all else. Cutting costs on rent and providing enjoyable work environments are important factors for enterprise success. We are surely in hard times, but these are

also ideal times to optimize office rental expenses and ensure maximum value for money is enjoyed by the business you are representing.