Buy vs. Rent Calculus for Different China Property Types

In Shanghai an apartment that costs USD 1 million typically rents for around USD 1,900 per month, while an office unit that costs the same typically rents

In Shanghai an apartment that costs USD 1 million typically rents for around USD 1,900 per month, while an office unit that costs the same typically rents

After two decades of waiting, Real Estate Investment Trusts (REITs) were finally approved and rolled out in China in 2021. For some it didn’t take long before

The global economic output grew by about USD 3 trillion during 2023, one-third of that stemming from China, according to estimates by the International Monetary Fund (IMF).

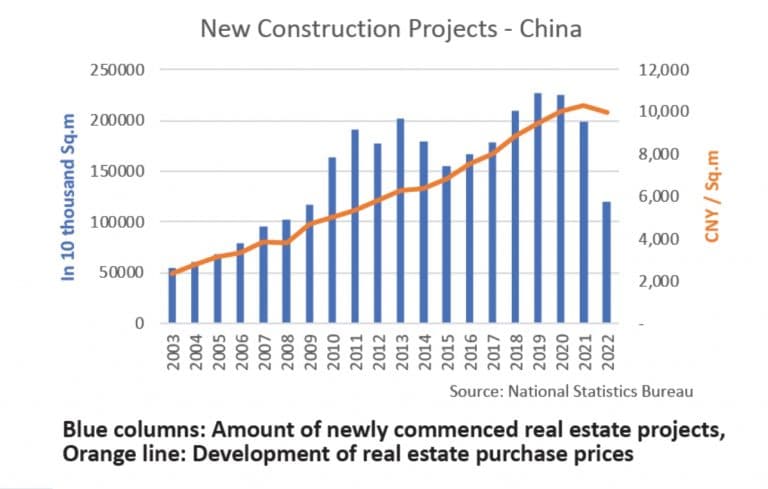

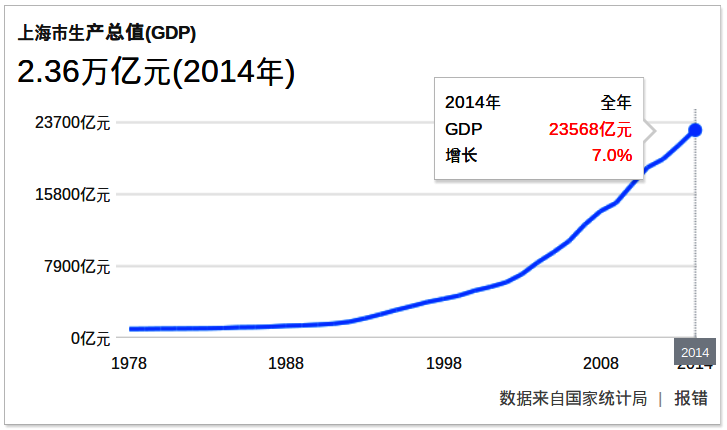

With a yearly GDP contribution of about 26% China’s construction and real estate industry has for decades been the main driver for the world’s second-largest

In China’s Cooled Economy the Property Market Temperature Depends on Where You AreEarly year hopes that China would quickly resume its role of world economic

Yangtze Delta’s Single-Focus Cities are Diversifying their Economies Many cities in the prosperous Yangtze River Delta are famous for having a unique industrial orientation. Taizhou, for example, is

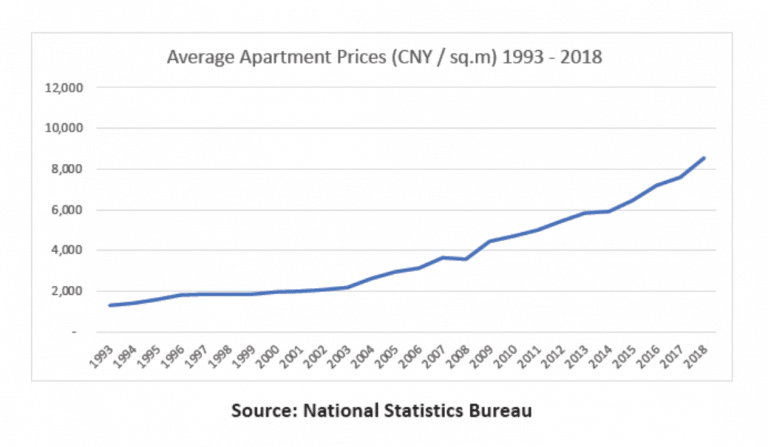

Painful Soft Landing for China’s Housing Market No matter the asset class, dramatic price booms are often followed by an even more dramatic price plunge that

Space is still expensive but the balance of power has shifted towards tenants Just a few years ago, when occupancies in Shanghai’s office market were as high

The opportunities and cost advantages may be greater than ever, but they now come with higher risk…

Investments are often speculative, sometimes made without considering…

Misconceptions around China’s Real Estate Industry Woes With the quasi-bankruptcy of Evergrande…

News reports and political speeches may have you thinking otherwise, but…

Effect of China’s recent shutdowns on its GDP, global trade and real estate The successful strategy for containing the coronavirus that China used in earlier stages of

Strange measurementsFor many years now, officially reported measures of inflation such as the Consumer Price Index (CPI) have been lower than the inflation that urban

The unfolding bankruptcy-slash-bailout of Chinese real estate developer Evergrande is a massive headache for thousands of the giant company’s stakeholders, and reflects risks of over-leveraging in the real

China’s F&B Industry is a Pillar of Commercial Real Estate, and It’s Changing Rapidly

The shift to working at home has been the biggest way the pandemic

has changed the way we work, but how enduring will it be?

The Five-Year Plans of the China government are broad guidelines for the development of the nation’s economy and society. The 14th Five-Year Plan was issued recently,

Government’s new ‘Red Lines’ policy dramatically changes the game for real estate developers and property investment firms. Increasing Challenges China’s big real estate companies had already

China has been receiving a continuous influx of foreign direct investment during this period of pandemic uncertainty and international trade tension. Overseas investors have been

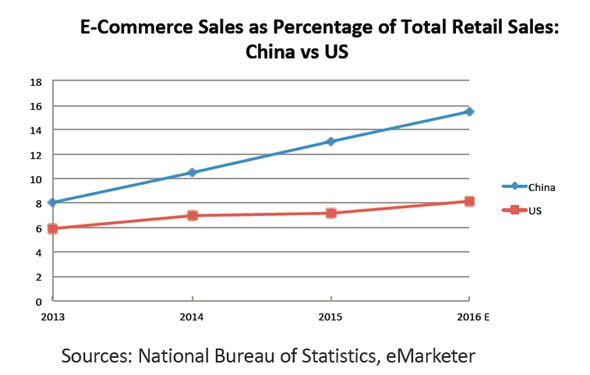

CrashWorldwide shopping malls are struggling as a result of the booming e-commerce industry. Some malls have even become ghost malls. Just a good decade ago malls were

Stock market risesA breakdown in global trading activities, a trade-war and one of the strictest Covid-lockdowns on earth: One would think this would crumble a large economy.

6 Strategies to free up cash, reduce costs, and generate additional income from your industrial and commercial real estate. For many businesses in China, this

Owners of commercial properties in Shanghai and many other China cities are in a pickle, with three trends converging to negatively impact their businesses. First,

Market ignores politics; international capital keeps flowing intoindustrial real estate in China Seemingly against all odds, a huge influx of capital from the U.S. and

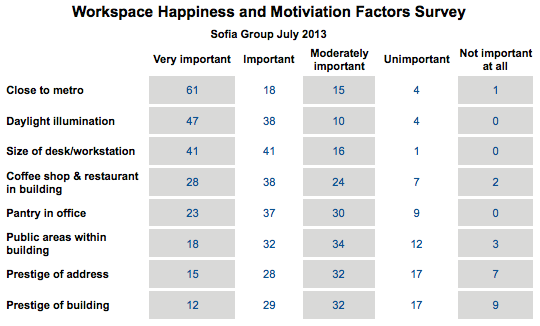

Employee loyalty is just one element of corporate success, but it is especially important in China where a highly competitive labour market makes it easy

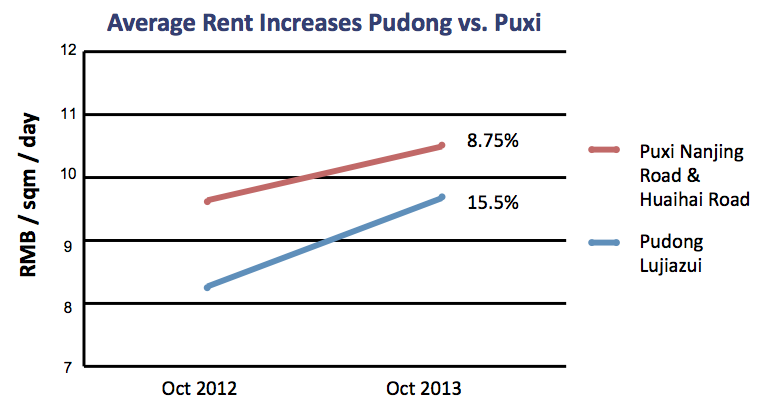

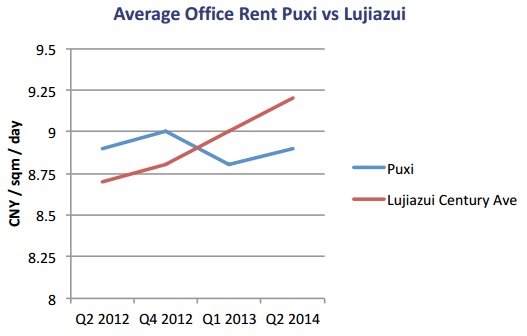

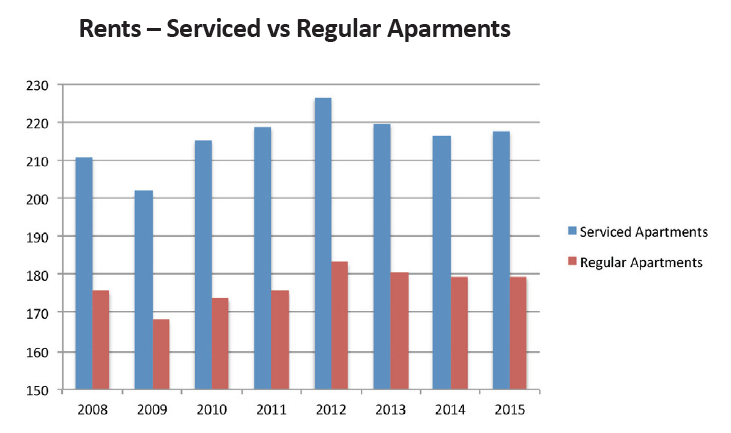

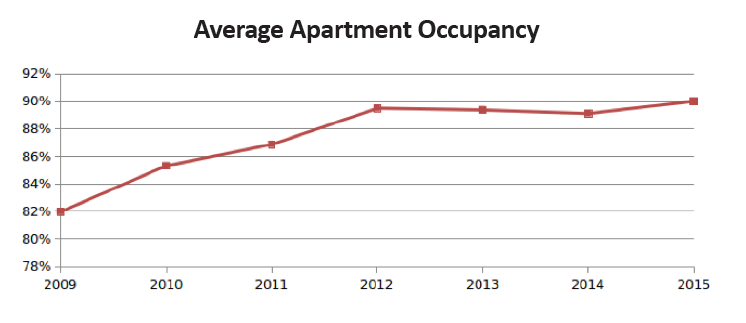

As noted in our last newsletter, office rents in the city largely stabilized in the second quarter of this year after a long period of

In our last newsletter we noted that after years of continuous increase, office rents in much of Shanghai have largely plateaued in the second half

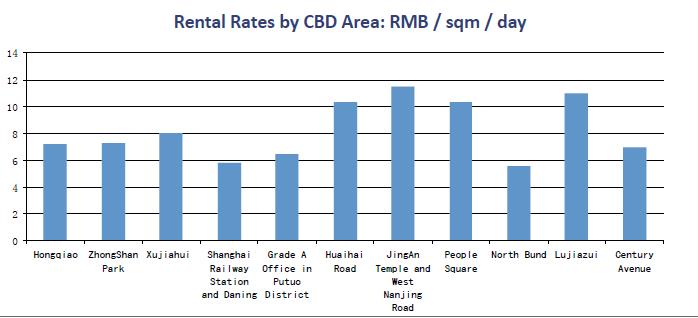

Investment, development in non-central areas, and changing market conditions were the big themes in Shanghai’s commercial real estate industry during 2013. We’ve rounded up what

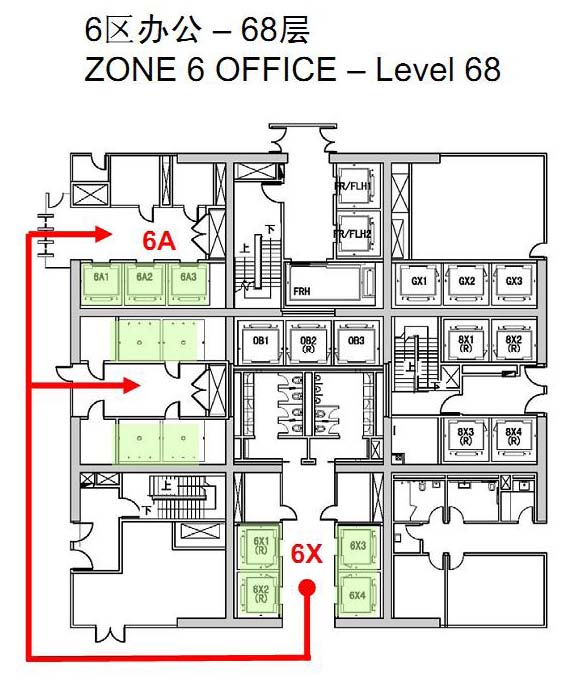

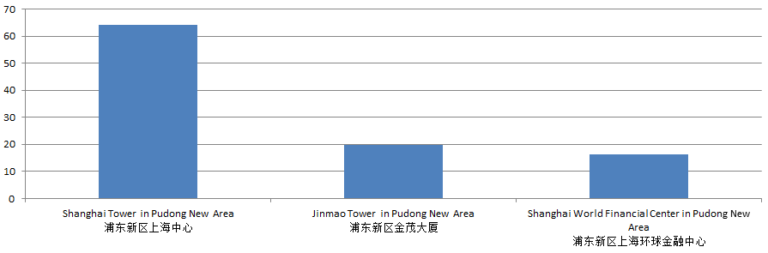

Although construction on Shanghai Tower will continue for about a year longer, management from many potential tenants have already inspected the site and the developers

China watchers are all abuzz these days about the slowdown in the country’s housing market. Although the average house price in China is still rising overall, the

China has for years now been a business hotspot for world-leading architectural firms, and Shanghai is of course one of the cities to benefit from

It was the best of times, it was the worst of times, it was the epoch of comfortably low rents, it was the era of budget-busting

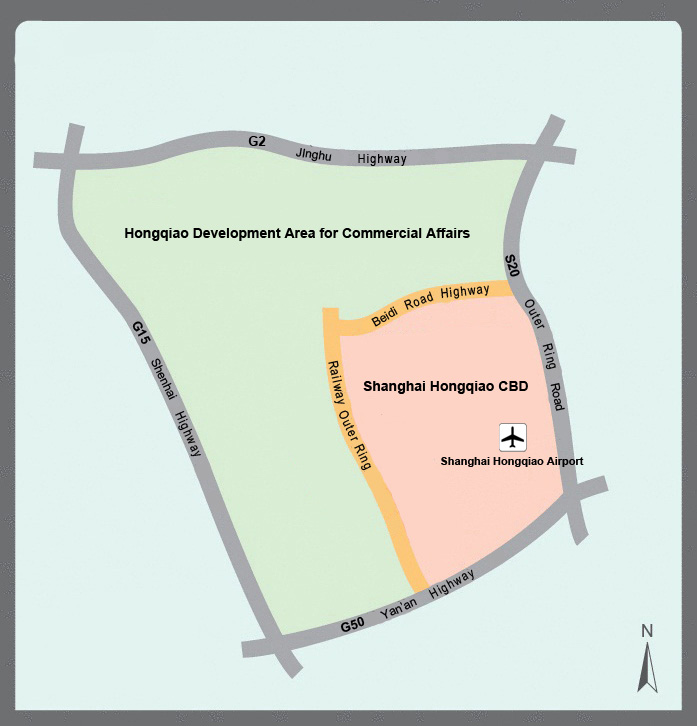

As our newsletter reader, you likely know that Hongqiao is an area in western Shanghai, and probably associate the name with the Gubei residential area

The myriad of spaces where economic activities are carried out in Shanghai becomes enriched with a host of spectacular new additions in 2015. The new

As the most salient elements of urban landscapes, commercial real estate developments occupy not just physical space on city streets, but also places in the

Currently in Shanghai there is a certain landmark office building that is leasing out space at rents that are 30% higher than rents at a

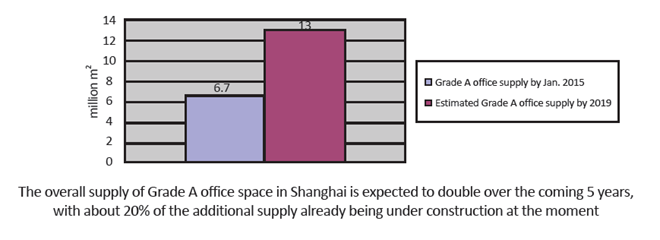

Significant amounts of new Grade A office space supply entering the market over the next few years and questions about the health of China’s economy

As discussed in our last issue, Shanghai will see a huge amount of new office space handed over in the coming five years, and much

Economic activity is the key factor determining demand for office space, and in an international metropolis like Shanghai, both the national and global economies exert

Are Serviced Apartments Shanghai’s Best Investment? The high demand for property that is characteristic of a booming metropolis has been attracting real estate investment to

Property prices are currently falling and investors registering losses in China’s third- and fourth-tier cities; yet in Beijing, Shanghai, Guangzhou, Shenzhen and the more prosperous of

Are Co-Working Spaces The Next UBER Or Investor Graveyards? Coworking spaces have taken the Shanghai real estate market by storm, and everyone seems to want in on

Foreign firms in China have most often played the role of buyer in property sales transactions, but in recent years we have been seeing more

Every year since around 2005 foreign media have been predicting an imminent and giant crash in the China housing market. The crash will be so

When a foreign company in China has to close or downsize, its management will need to see to a range of matters such as compensation of laid-off

In the past three years the JC Mandarin Hotel on Nanjing Xi Lu, the Galaxy Hotel on Yan An Xi Lu, and the Lansheng Hotel

The Shanghai retail scene continues its ongoing makeover in 2017 as another host of new malls opens for business and long-established retailers reinvent themselves in

Shanghai’s office market continues to be seen as an attractive investment for major foreign and domestic firms. Large scale deals have marked recent months and

On 18 August, this year the Chinese government rolled out its latest restrictions on overseas direct investments. Much has been made of the recent changes to regulations